Deferred comp calculator

Get contact information for your financial guidance professionals and plan administrators. This calculator helps illustrate what it might take to eventually reach your objectives.

Mo Deferred Comp

This calculator uses your personal information to develop a custom savings forecast that takes into consideration pension social security the deferred compensation plan and other savings.

. Thats why one common strategy is to use a deferred comp plan as a bridge in retirement income. It provides you with two important advantages. Dont forget about potential health care costs.

Use this calculator to learn more about the Roth option and decide which is best for your situation - pre-tax or after-tax savings. How much can I save. Outdated or Unsupported Browser.

DCP savings calculator DCP retirement planner Plan 3 members Retirement Benefits. First all contributions and earnings to your 457. How long will my money last.

Compare an after-tax Roth savings option with a traditional pre-tax retirement savings plan. The purpose of the 457 Savings Calculator is to illustrate how the 457 can help you save for your retirement. Learn what type of investment.

The Deferred Compensation Program has these calculators available. What pay period contribution is of my annual salary of. The Deferred Compensation Program DCP is a special type of savings program that helps you invest for the retirement lifestyle you want to achievea lifestyle that might be hard to reach.

Use this calculator to calculate the new principle after deferring a loan for a defined period of time. Taking a loan from hisher Deferred Compensation Plan account can greatly impact ones future account balance. You are using an outdated or unsupported browser that will prevent you from accessing and navigating all of the features of our.

This calculator was created by Charles Schwab Inc for private sector 401k. Retirement Withdrawal Calculator Use this calculator to help you. ICB Solutions a division of Neighbors Bank.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. It can fill the gap between income earned. Select your monthly DCP contribution.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Here are some tools and calculators that may help you get a better idea about what you will need. Dollar to Percent Calculator.

Defer payment from 30 to 180 days and see. Pay Period is semi. Alameda County Deferred Compensation Plan Plan Resources Quick Actions.

Therefore a participant should consider other ways to cover unexpected. How much can I withdraw. A 457 can be one of your best tools for creating a secure retirement.

My annual salary is. Youre eligible for retirement. Nonqualified Deferred Compensation Planner.

Investor Type What type of investor are you. I would like to contribute each pay period. Deferred Payment Calculator.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Once youve logged in to your account you will.

Compound Interest Calculator Daily Monthly Quarterly Annual

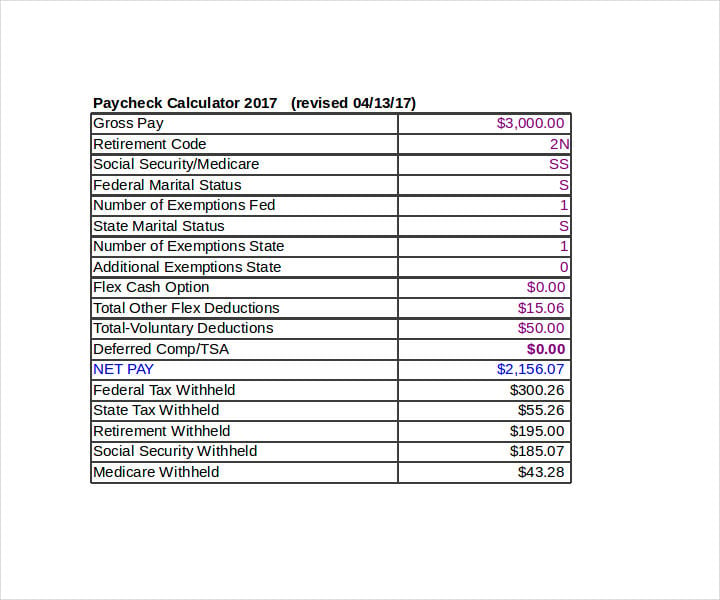

Net Pay Calculator Powerpoint Presentation Next Ppt Download

Nonqualified Deferred Compensation Planner

11 Paycheck Stub Templates In Excel Free Premium Templates

Deferred Compensation Plan Best Way To Reduce Taxes Story Financial Freedom Countdown

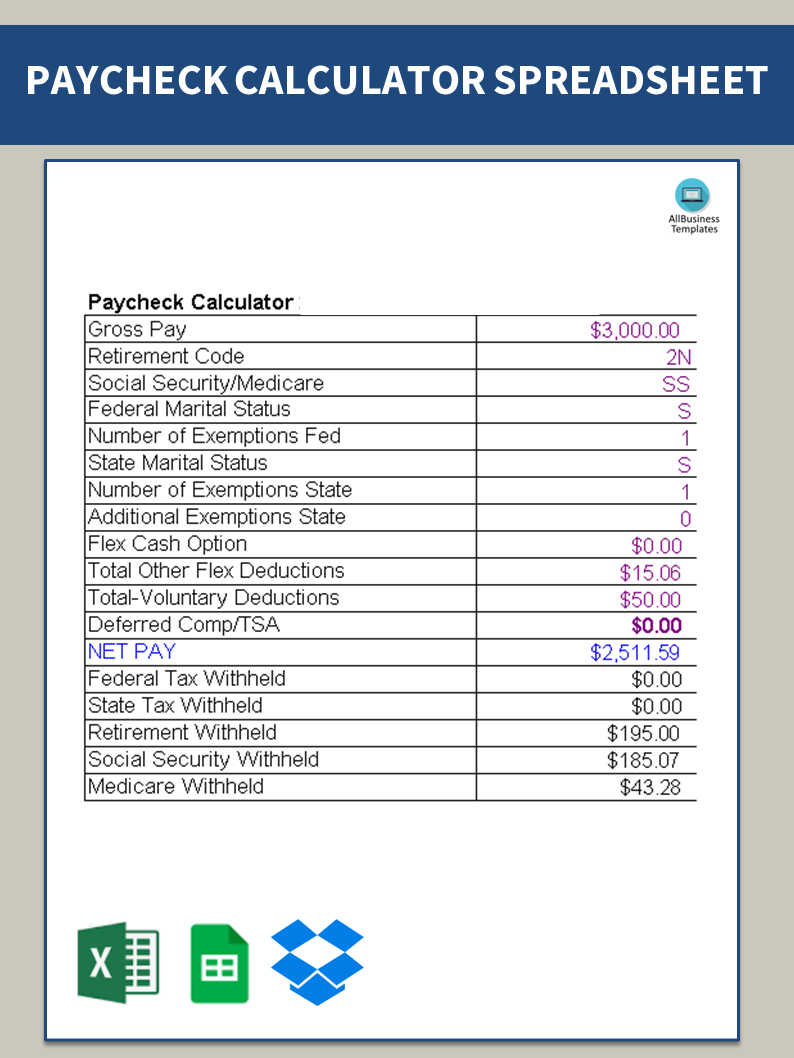

Paycheck Calculator Templates At Allbusinesstemplates Com

2

457 Deferred Compensation Plan

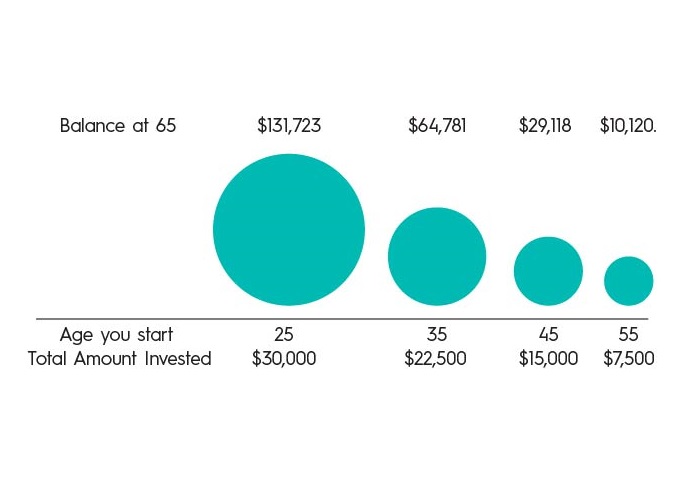

Future Value Calculator

Deferred Income Tax Hi Res Stock Photography And Images Alamy

Deferred Compensation Portland Gov

Mo Deferred Comp

2

Acdc Account Computation

2

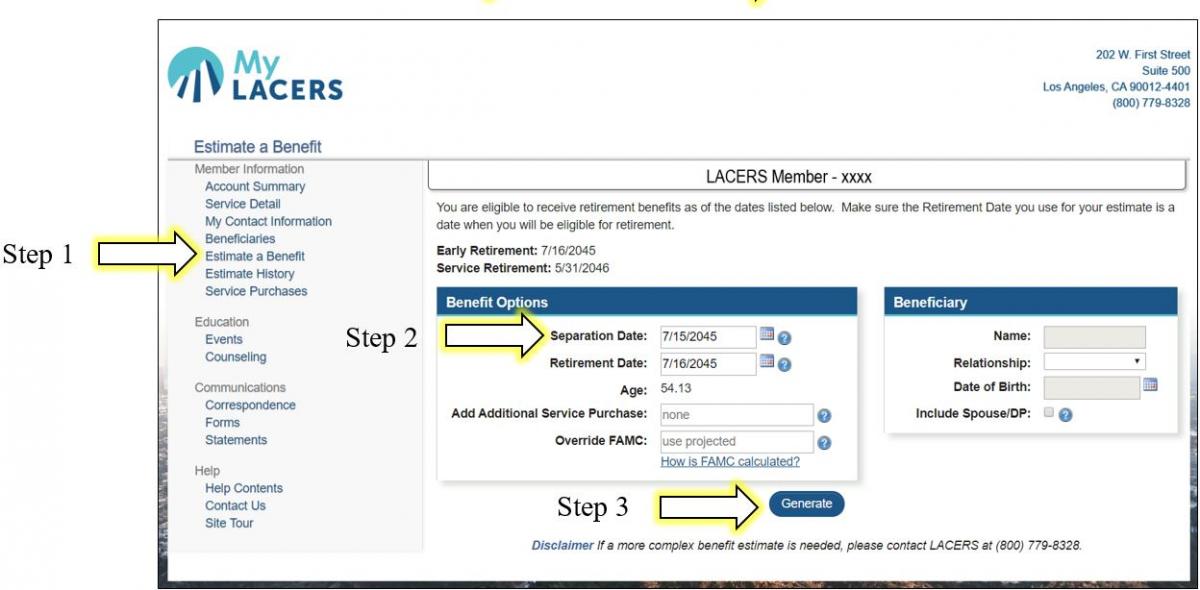

Explore Benefit Calculators Los Angeles City Employees Retirement System

Deferred Annuity Intro Youtube